Discover how a SIP Calculator simplifies wealth creation through disciplined investing. Learn to estimate returns, leverage compounding, and tailor strategies with Groww’s user-friendly tool. Perfect for planning goals like retirement, education, or buying a home—no jargon, just actionable insights. Start your journey to financial freedom today!

SIP Calculator

Results

Total Investment: ₹0

Final Amount: ₹0

What is a SIP Calculator?

A Systematic Investment Plan (SIP) Calculator is a digital tool designed to help investors estimate the potential returns on their SIP investments in mutual funds. SIPs allow individuals to invest a fixed amount regularly (monthly, quarterly, etc.) in mutual funds, leveraging the power of compounding and rupee-cost averaging. The SIP calculator simplifies complex financial calculations, enabling users to visualize their wealth accumulation over time based on variables like investment amount, duration, and expected rate of return.

This tool is indispensable for both new and seasoned investors, as it provides clarity on long-term financial goals such as retirement planning, buying a home, or funding education. Unlike manual calculations, a SIP calculator delivers instant, accurate results, making it a cornerstone of modern financial planning.

How Can a SIP Return Calculator Help You?

- Goal Setting:

A SIP calculator helps you align investments with specific financial goals. For instance, if you aim to save ₹50 lakhs in 10 years, the tool will compute the monthly SIP required to achieve this target. - Visualizing Compounding:

Compounding is the process where your returns generate further earnings. A SIP calculator demonstrates how even small, regular investments can grow exponentially over decades. - Risk Mitigation:

By adjusting the expected rate of return (e.g., 12% for equity funds vs. 8% for debt funds), you can assess risk-reward trade-offs and choose funds that match your risk appetite. - Flexibility:

Experiment with different investment amounts, tenures, and returns to create a strategy tailored to your financial capacity. - Informed Decision-Making:

Avoid guesswork by relying on data-driven insights to optimize your portfolio.

How Do SIP Calculators Work?

SIP calculators use the future value of an annuity formula to compute returns. The formula is:FV=P×[(1+r)n−1r]×(1+r)FV=P×[r(1+r)n−1]×(1+r)

Where:

- FV = Future Value of Investment

- P = Monthly SIP Amount

- r = Expected Monthly Rate of Return (Annual Rate ÷ 12)

- n = Total Number of Installments

Example:

If you invest ₹10,000/month for 15 years at an annual return of 12%:

- Monthly Return (r) = 12%/12 = 1%

- Total Installments (n) = 15 × 12 = 180

- FV = ₹10,000 × [(1 + 0.01)^180 – 1]/0.01 × (1 + 0.01) ≈ ₹52.32 lakhs

The calculator automates this math, letting you focus on strategy.

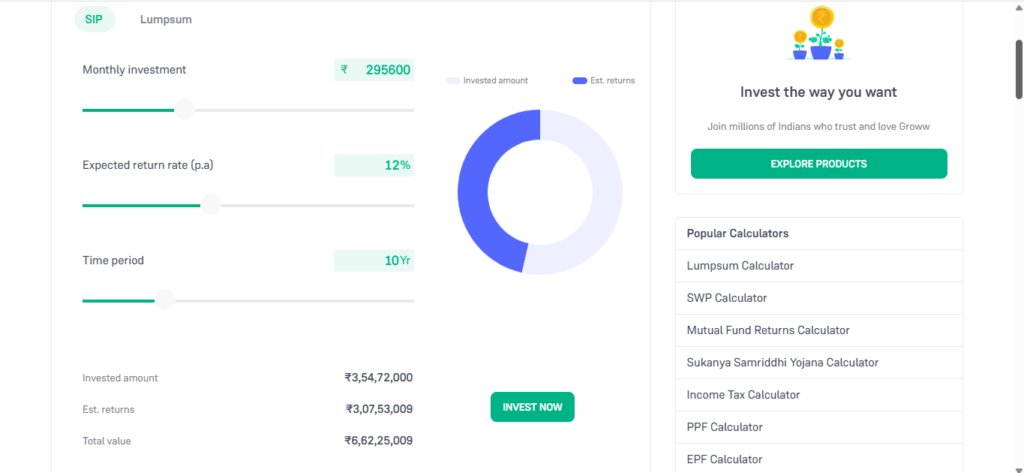

How to Use Groww’s Systematic Investment Plan Calculator

Groww, a leading Indian investment platform, offers a user-friendly SIP calculator. Here’s a step-by-step guide:

- Visit Groww’s Website/App:

Navigate to the “SIP Calculator” tool under the “Mutual Funds” section. - Enter Investment Details:

- Monthly Investment Amount: Enter your SIP contribution (e.g., ₹5,000).

- Investment Tenure: Choose the duration (e.g., 10 years).

- Expected Annual Return: Input a realistic rate (e.g., 12%).

- Click “Calculate”:

The tool instantly displays:- Total Invested Amount: Sum of all SIPs.

- Estimated Returns: Wealth gained from compounding.

- Total Corpus: Final maturity amount.

- Adjust Parameters:

Tweak values to compare scenarios (e.g., increasing tenure to reduce monthly SIPs).

Why Groww’s Tool Stands Out:

- Simplicity: Intuitive interface for beginners.

- Accuracy: Real-time computations.

- Free Access: No registration required

Advantages of Using Groww’s SIP Calculator

- Time Efficiency:

Skip manual calculations; get results in seconds. - Transparency:

Detailed breakdown of invested amount vs. returns. - Goal Customization:

Plan for short-term (3–5 years) or long-term (10+ years) goals. - Educational Resource:

Learn how compounding and discipline amplify wealth. - No Bias:

The tool doesn’t promote specific funds, ensuring unbiased insights.

FAQs About SIP Calculators

Q1. Are SIP returns guaranteed?

No. SIP returns depend on market performance. Historical data suggests equity SIPs average 10–15% annually, but past performance ≠ future results.

Q2. Can I change my SIP amount later?

Yes. Most mutual funds allow increasing, decreasing, or pausing SIPs.

Q3. How accurate are SIP calculators?

They provide estimates based on inputs. Actual returns may vary due to market volatility.

Q4. Is SIP better than lump-sum investing?

SIPs reduce timing risk through rupee-cost averaging. Lump-sum suits bullish markets.

Q5. Do SIP calculators account for inflation?

No. Adjust your expected return rate to include inflation (e.g., use 10% instead of 12%).

Q6. Are there tax benefits with SIPs?

Equity-linked SIPs (ELSS) qualify for ₹1.5 lakh tax deduction under Section 80C.

jaBZkyn pRubX JJeN EEeTlULl HjZLKu